3D Secure

3-D Secure is a security protocol designed to ensure enhanced security and reduce fraud for online credit card transactions. It involves an additional layer of authentication that helps verify the identity of the cardholder during online purchases. Here is a detailed overview of the 3-D Secure protocol and its application across different card networks.

MasterCard® SecureCode™, Verified by Visa, and American Express SafeKey

These are unique standards aimed at identifying and authenticating the cardholder during online transactions, significantly reducing the risks involved for merchants.

How Identification Works

All participants (merchants and consumers) are registered in central databases managed by the card networks. Consumers are registered with specific characteristics by the card issuing institution (issuer). Merchants are linked to a unique identification number provided by the entity with whom they have a credit card acceptance agreement. This setup allows the characteristics of both the consumer and the merchant to be compared using a Merchant Plug-in (MPI) linked to the merchant's payment system.

American Express SafeKey Specifics

- Liability: If everything is registered via SafeKey, American Express assumes the liability.

- Consumer Registration: Consumers are offered three chances to register. If the consumer does not register after three attempts, the transaction is cancelled.

- Non-participating Countries: For cards issued in countries not participating in the SafeKey program, the liability lies with the merchant.

Liability Shift

With 3-D Secure, the liability for fraudulent transactions shifts from the merchant to the card issuing institution provided the transaction is authenticated using the 3-D Secure protocol. This shift does not cover disputes related to product delivery or quality.

Liability Shift Table

| Card Type | Enrolled | Status | Liability |

|---|---|---|---|

| Visa & Amex | U | - | [Cancelled] |

| Visa & Amex | N | - | Card Issuer |

| Visa & Amex | Y | Y | Card Issuer |

| Visa & Amex | Y | N | [Cancelled] |

| Visa & Amex | Y | A | Card Issuer |

| Visa & Amex | Y | U | [Cancelled] |

| MasterCard | U | - | [Cancelled] |

| MasterCard | N | - | [Cancelled] |

| MasterCard | Y | Y | Card Issuer |

| MasterCard | Y | N | [Cancelled] |

| MasterCard | Y | A | Card Issuer |

| MasterCard | Y | U | [Cancelled] |

| Maestro | U | - | [Cancelled] |

| Maestro | N | - | Card Issuer |

| Maestro | Y | Y | Card Issuer |

| Maestro | Y | N | [Cancelled] |

| Maestro | Y | A | Card Issuer |

| Maestro | Y | U | [Cancelled] |

| Bancontact | U | - | [Cancelled] |

| Bancontact | N | - | [Cancelled] |

| Bancontact | Y | Y | Card Issuer |

| Bancontact | Y | N | [Cancelled] |

| Bancontact | Y | A | [Cancelled] |

| Bancontact | Y | U | [Cancelled] |

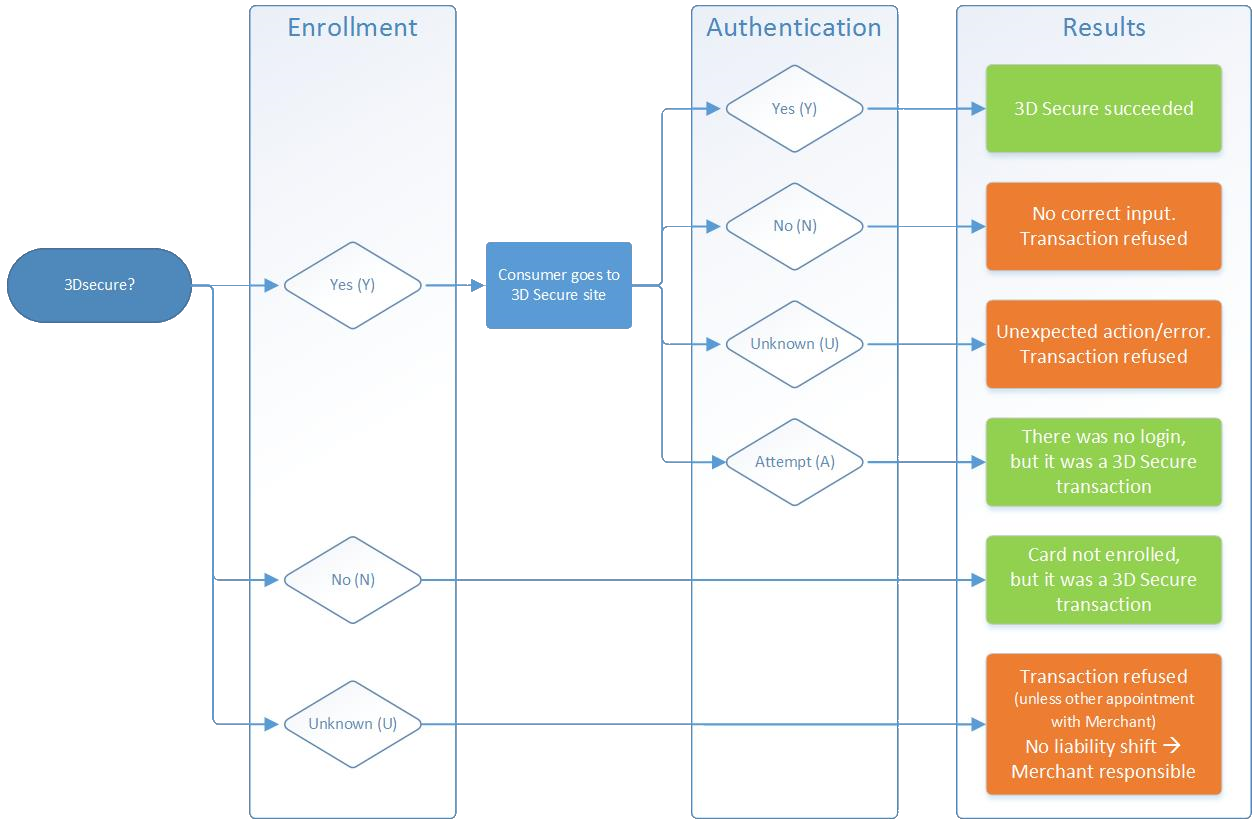

Explanation

- Enrollment: Indicates if the card is enrolled in the 3-D Secure system.

- U = Unknown

- N = No

- Y = Yes

- Authentication Status:

- Y = Yes

- N = No

- U = Unknown

- A = Attempt

Dynamic 3-D Secure (3DS)

For Worldline Collecting, merchants can set a transaction amount limit in the Plaza. Transactions below this limit skip the 3-D Secure authentication, assuming lower fraud risk. This feature, however, is not available after implementing Strong Customer Authentication (SCA) via 3DS 2.x.

Important Notes

- Bancontact: 3-D Secure authentication for Bancontact payments involves an additional code generated using a digipass or card reader.

- Liability in Non-Participating Countries: For cards from countries not in the SafeKey program, the liability falls on the merchant.

By understanding and implementing 3-D Secure protocols, merchants can reduce fraud and shift liability to card issuers, providing a safer online shopping experience for customers.

Updated 12 months ago