Bank statements

A common question is how accounting and Buckaroo reporting can cooperate effectively. Since there are numerous accounting packages, the answer can vary. However, the explanation provided here is a basic overview applicable to all accounting packages. Buckaroo Payment Plaza offers many formats for different accounting packages, including automatic statement provision via the Buckaroo SFTP server, where a daily statement is made available.

When it comes to the processing in accounting packages that can only work with already paid orders, such as Exact and SAP, it applies that reconciliation of the invoices with the Buckaroo statements is easily performed for invoice numbers in closed ranges by using the order number as a key in the execution chain.

Formats

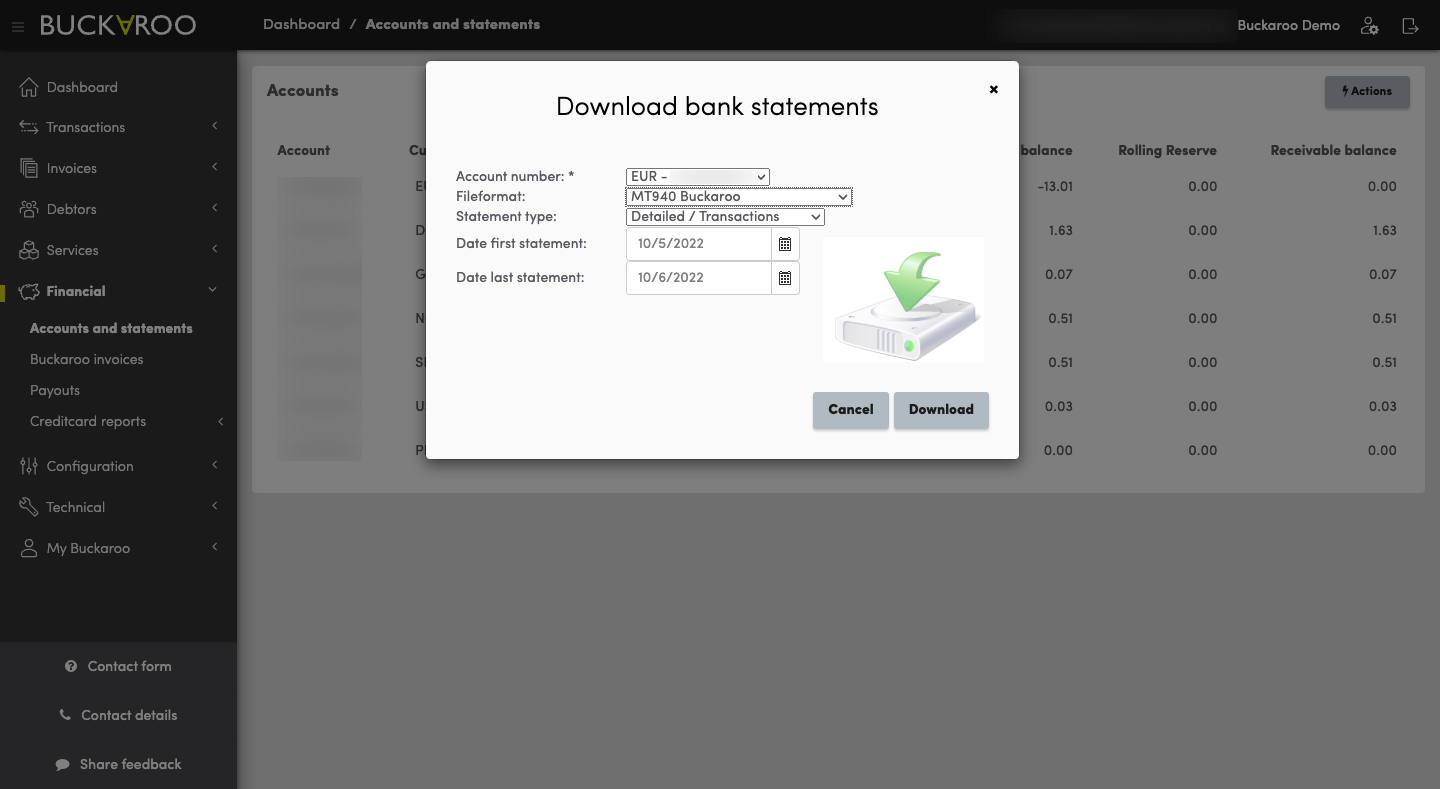

Bank statements in Buckaroo Payment Plaza can be downloaded in several formats:

- MT940: Multiple variants tailored to different accounting packages.

- CAMT053: Standard bank statement format.

- CSV (Comma-Separated Values): For direct download of mutation lines as journal entries.

File contents

Each line in the statements and CSVs is given a transaction type, allowing differentiation per type of mutation. For instance:

- Revenue types:

- iDEAL: Transaction type C021

- Authorizations: Transaction type C004

- Costs:

- Registered under different transaction types in the general ledger ‘Buckaroo payment transactions costs’.

- Collected administrative costs:

- Registered with their own transaction type (Axxx), processed separately from revenue in accounting.

Integration with accounting packages

It's crucial to distinguish between collecting payment methods and processing payment methods.

- Collecting: Buckaroo collects money on behalf of the Merchant on an account managed by Stichting Derdengelden (third-parties account). Reconciliation is performed according to the Merchant's communicated payment obligations.

- Revenue highlighted in orange: In 'Buckaroo journal posts'.

- Processing: Buckaroo uses the account details provided by the Merchant, crediting amounts directly to the account.

- Revenue highlighted in blue: In 'Buckaroo journal posts'.

The transaction types on Buckaroo statements/reports (green section) determine the general ledger where journal entries should be included. For collecting payment methods, the front end or back end items (blue section) are the cross-entry on the general ledger accounts. For processing payment methods, the third-party account statement lines are used for cross-entry on the general ledgers.

Accounting terms

- Journal Entry: Indicates which general ledger accounts are debited and credited.

- General Ledger: The master set of all general ledger accounts.

- General Ledger Account: A collection of equal expenditure and revenue items, categorized into balance sheet accounts and income statement accounts.

- Balance Sheet Account: Amounts listed on a company’s balance sheet, including assets (buildings, inventory), liabilities (loans, creditors), and equity.

- Income Statement Account: Financial statement showing details of purchases, sales, expenses (travel, salaries, advertising), and interest.

Updated 12 months ago