Tokenization

Tokenization is an advanced technology designed to protect sensitive data by substituting it with a unique set of characters—either letters, numbers, or a combination of both. This set, known as a token, holds enough information to retrieve the original data but only within a secured environment. This ensures that only authorized users can access the sensitive information. Moreover, when tokens are unique per account, obtaining one token doesn't compromise other accounts, enhancing overall security.

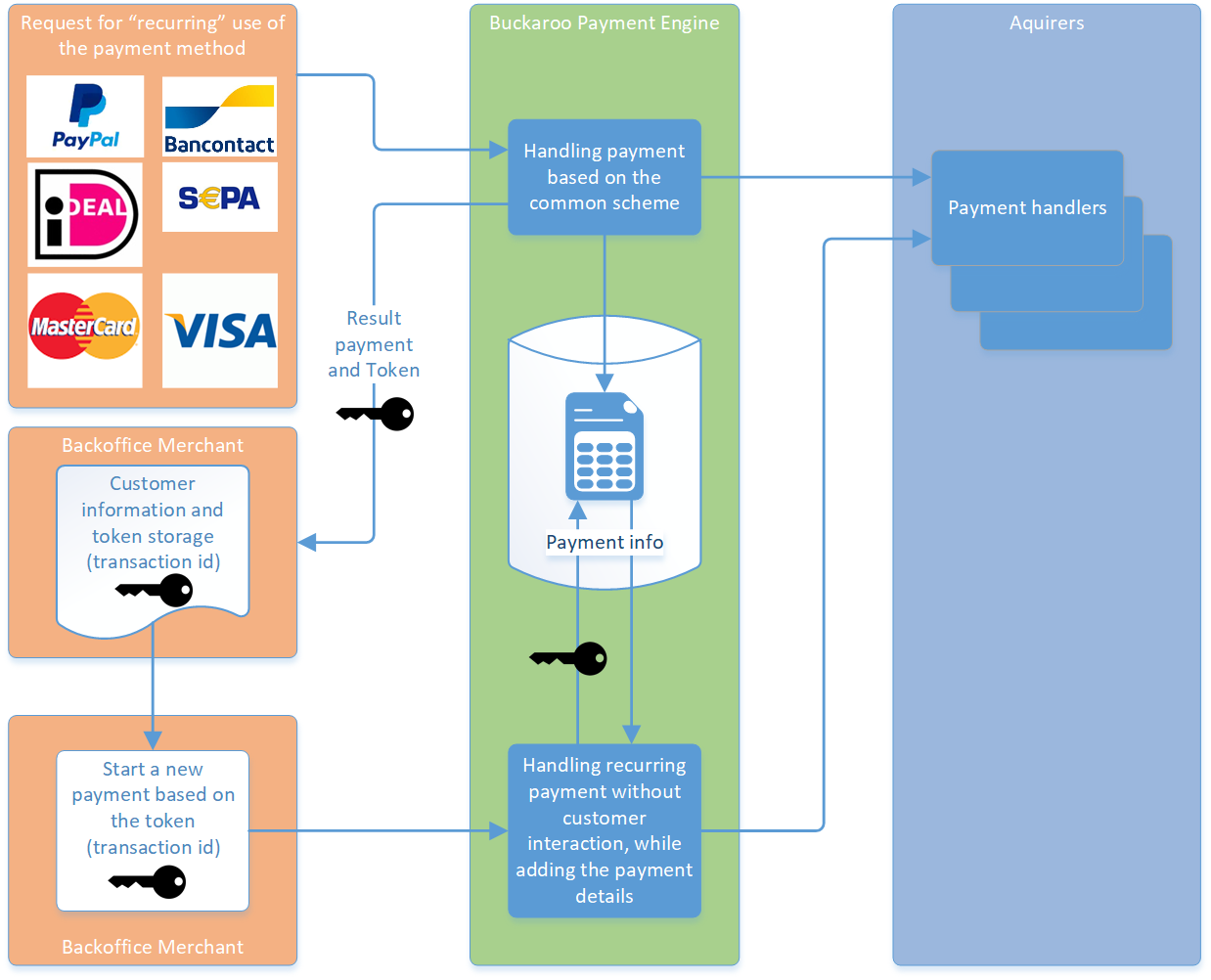

How tokenization works at Buckaroo

At Buckaroo, tokenization is utilized for payment methods that support recurring transactions. These include:

The tokenization process is structured as follows:

- The payer completes a payment within the secured environment of the issuer (such as a bank or credit card company).

- The issuer then shares the payment data with Buckaroo.

- Buckaroo generates a token—a reference to the payment data—and shares it with the merchant.

- Using the Buckaroo token, the merchant can initiate future payments using the original payment method.

Benefits of tokenization

- Enhanced Security: Sensitive payment and banking data are stored securely within Buckaroo’s environment, which is regularly audited by supervisors based on various stringent factors.

- Data Privacy: By storing data securely, the merchant receives a token instead of the actual payment data, ensuring privacy.

- Ease of Recurring Payments: For example, after a successful iDEAL transaction, a merchant can later perform a SEPA Direct Debit using the token from the original iDEAL payment.

Token theft mitigation

Tokens, by design, are rendered useless if stolen by criminals. This is because:

- Tokens can only be utilized through an encrypted login method provided to the merchant.

- Merchants can use tokens to retrieve payment data, providing transparency to customers about stored information.

- This system applies to all payment methods supporting recurring payments.

Reversal and dispute management

It’s important to note that recurring payments can be reversed by the card or account holder, as the payer isn't directly involved in subsequent transactions. Merchants can contest these reversals by submitting relevant service documentation. Additionally, Buckaroo’s Credit Management services can offer added protection for these transactions.

Network tokenization for credit card transactions

With recurring payments, card details are stored for future transactions. As explained above, we do this through an internal tokenization service by Buckaroo. Since 2025, Buckaroo has also introduced Network Tokenization for credit card transactions. With this technology, card data is replaced by a token that is issued and managed directly by the card networks themselves, such as Visa and Mastercard.

These tokens are linked to the cardholder instead of to a specific card. This means they remain active even when a customer receives a new card or the expiration date changes.

This means:

- No interruptions when cards are renewed or expiration dates change. Payments continue automatically without customer intervention.

- More trust from card issuers, resulting in a higher approval rate.

- Higher conversion for subscription payments and less lost revenue.

You can read more about this in our blog about Network Tokenization.

Updated 4 months ago